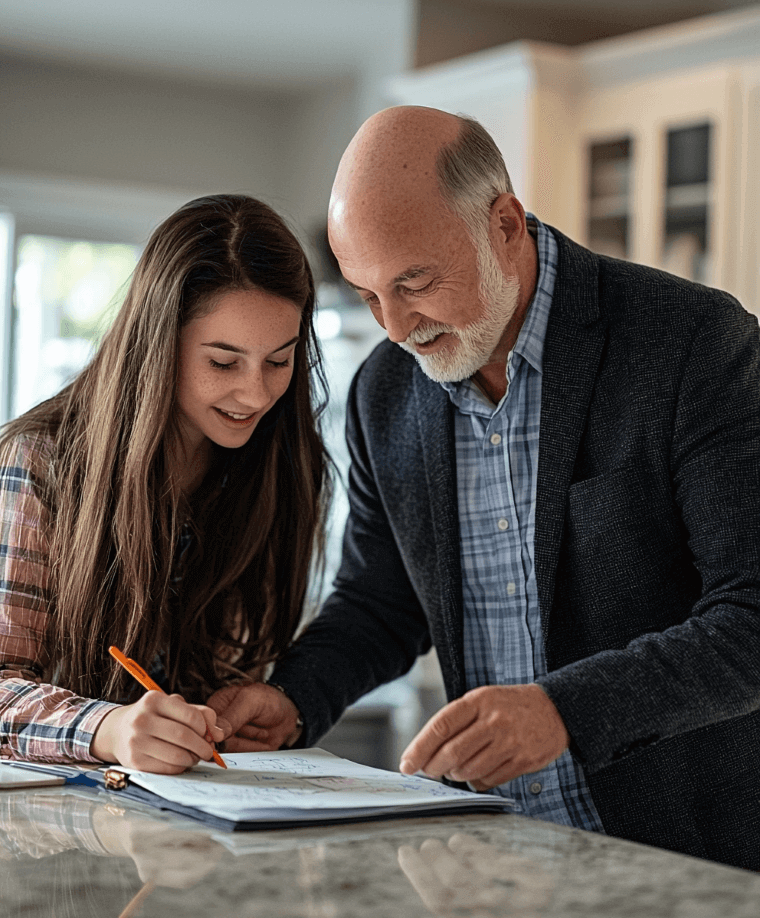

Maximising Certainty for You and Your Family

Family is important. It's a big reason why we do what we do, and it's likely the same for you.

Living life to the fullest means maximising the certainty of achieving your aspirations. It means wanting the best for your family and being the best version of yourself. Ensuring your family is taken care of, regardless of what speed bumps or roadblocks life may bring, is essential. This is true whether you're a major income earner or not.

Our process begins with an in-depth discovery, often starting with our aspirations mapping process. Through this exploration, we create a holistic plan or pathway for your future and potentially for generations to come. The comprehensive approach allows us to understand your unique situation and what truly matters for your future and for your family.

Our approach carefully considers the various aspects and risks interfering achievement of your aspirations, and plans for preparing and protecting your family's future:

-

Assessing your current plans and strategies and managing the risks to those plans

-

Exploring options to safeguard against both life's likely and unexpected challenges

-

Considering strategies and impacts from health-related issues, serious illnesses, and maintaining income needs for the life you're working toward

When it comes to implementing specific risk mitigation strategies using financial products or risk insurance solutions to address these needs, Bruce works with clients in his capacity as a member of the SHARE NZ team.

However, risk mitigation strategies are just one part of protecting and preparing for the future you and your family want. Our holistic approach goes beyond this, aiming to align all aspects of your planning with your aspirations.

This overall strategy enables you to ensure all your advisers are on the same page, working towards achieving your mapped family aspirations and long-term goals. We can facilitate and project manage parts of the process, introducing you to trusted professionals as needed to support you and your family on your journey.

Our aim is to develop, facilitate and integrate approach ?? to your family's future planning, addressing both your current needs and long-term aspirations.

Personal & Family Risk Management

Many of us are quick to protect tangible assets like our homes, cars, or boats. Travel and contents insurance are often top of mind because most of us have had accidents with vehicles or around the home. But have you considered strategies to protect your most valuable asset - you, and your ability to earn an income or deliver daily care for your family?

Consider this: When your income suddenly stops due to an accident or serious illness, how financially prepared are you? How many weeks could you manage from savings and investments before the money runs out? It's crucial to explore strategies that can help you and your loved ones maintain your lifestyle and provide peace of mind, regardless of what life may bring.

We specialise in navigating the often complex intersection between your needs as a business owner, shareholder, likely a key person, and the needs of your family. Our holistic approach considers both personal and business aspects and the complex income crossover to create effective and comprehensive risk management strategies.

When it comes to implementing specific risk mitigation strategies using financial products or risk insurance solutions to address these needs, Bruce works with clients in his capacity as a member of the SHARE NZ team.

Our goal is to help you develop a robust plan that protects what matters most to you - your ability to provide for and care for your family as you've hoped and planned for, while also safeguarding your business interests and assets that you have worked hard and sacrificed to create. By addressing these crucial aspects of personal and business risk management, you can focus on your goals and aspirations with greater confidence and security.

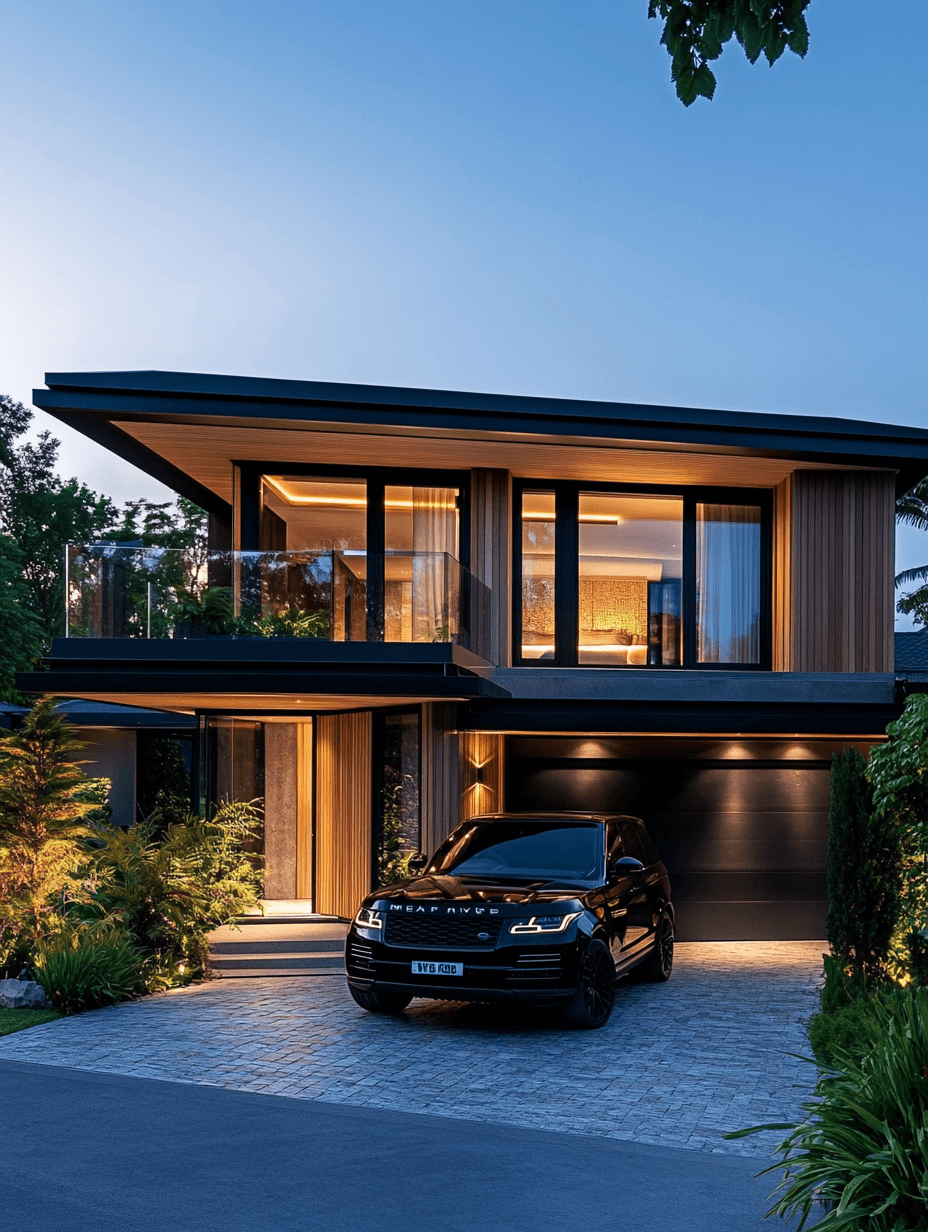

Securing Your Home: Protection Strategies for Keeping the House and Paying the Bills

For many of us, our home is one of our largest assets and a significant portion of our income goes towards housing costs, whether it's managing the mortgage payments, rates, insurance, and maintenance. Most of us also like to eat and enjoy more than a modest lifestyle.

Having a place to call our own is important, but these payments and our living costs don't magically stop just because you became seriously ill or badly injured. It's critical to consider strategies to protect one of your biggest assets and the ability to maintain these costs when serious issues strike.

Many people are surprised to learn that our largest asset is actually our income, not our property. Consider your current income and multiply this by the number of years you plan to work until retirement. Even before allowing for future increases to your income, the total value is frequently surprising and often much higher than the value of any property you own. Yet despite this economic reality, we frequently place greater emotional value on the home we live in than on our income-generating capability.

Some key points to consider:

Effective planning, strategies and protection can enable choices and options, leaving you the freedom to focus on recovery from major accidents and serious illness while the majority of your monthly expenses are taken care of. This can alleviate the many pressures on you and your loved ones during the most difficult times in your life.

How long can you maintain your mortgage payments and usual living costs from cash reserves and investments while still allowing for retirement? This is a very difficult time to increase your mortgage or borrow further when your income has gone. It's often not the best time for selling valuable assets in haste or using retirement savings to live off while not knowing when you will be earning and fit for work again.

Planning for the Unthinkable

It seems whenever the subject of dying comes up in conversation, it's mostly linked to aeroplanes falling out of the sky or being hit by a bus, neither of which are terribly likely.

Should we pass away before retirement, it's much more likely due to a serious and often prolonged medical situation. Even then, our health system tends to keep us alive much longer than ever before, leaving us feeling somewhat bulletproof and ten feet tall.

Unless we're facing an immediate health problem, few of us think much about being diagnosed as critically ill or permanently disabled. None of us expect to face the reality of learning that recovery from a serious accident will be slow and uncertain. We don't imagine starting with feeling unwell, only to discover we're critically ill with an uncertain or grim outlook.

None of us expect this devastating news, yet having strategies and plans in place—both practical and financial—is essential.

Key considerations that are often challenging to organise include:

When you can't practically or mentally make your own decisions, it's critical to have the right personal legal authorities in place. This often includes:

-

Enduring powers of attorney for both personal welfare and property

-

Power of appointment for your business roles as a director

-

Power of appointment for replacement trustees for your trust

Financial considerations are equally important:

-

Funds that allow the dignity of choices and options to meet your daily living costs

-

Financial resources to adjust your life to significant change and uncertainty, whether through lump sums or ongoing income

-

Integration of risk protection funding benefits with other risk management strategies

Our goal is to help you develop a comprehensive plan that provides options and dignity, even in the face of serious illness, injury, or disability. With these crucial aspects addressed, you and your family can focus on what matters most—your wellbeing, recovery, and maintaining quality of life—with greater peace of mind and certainty during uncertain times.

When it comes to implementing specific risk mitigation strategies using financial products or risk insurance solutions to address these needs, Bruce works with clients in his capacity as a member of the SHARE NZ team.

Estate Planning Considerations - Before You Need It!

Having an up-to-date estate plan is a crucial part of preparing for the future. It's natural to feel the need for this is, well, a long way off. One of the kindest things you can do for your family is to have clearly outlined your wishes for what happens after you pass away, including who will manage your estate and family trust during a time that is naturally always upsetting and frequently stressful for your family.

Through our experience, we've observed that one of the leading reasons you might delay estate planning is the challenge of deciding on guardianship for your children. Common concerns include avoiding those "least favoured" family members or the guardians you want to appoint don't have the space in their home right now. And should the guardians also look after the assets and funds as executors, or must the children live with the guardians?

Easy assumptions, such as relying on grandparents to take on this role, may need to be revisited as circumstances will gradually change over time. It's important to think through questions like:

-

Who would be the best guardian for your children now if the worst has happened to you?

-

Should the guardian of your children be the same person who manages the estate and how could this work?

-

Do you have alternatives as family situations evolve, especially for blended families?

We frequently offer a fresh perspectives and help facilitate these important but difficult conversations. Our role is to help you think through the crucial issues and consider various scenarios allowing strong decisions. Having clarified your perspective and considered your wishes, we can work with your lawyer or estate planner to ensure your estate plan accurately reflects your wishes and intentions.

Remember, estate planning is not just about distributing assets - it's about ensuring your loved ones are cared for according to your wishes. By addressing these important matters, you gain peace of mind knowing you've managed the steps to protect what matters most to you.

When technical or professional advice is needed in areas such as legal, tax, accounting, or business structure, Bruce will coordinate with your existing advisers or help you find appropriate specialists. For specific risk management strategies involving insurance solutions or financial products, Bruce works with clients in his capacity as a member of the SHARE NZ team.

Our goal is to help you create a robust plan that aligns with your values and provides for your loved ones in the way you would wish for and intend.